Net Present Value Method in Financial Management (NPV)

Contents

Net Present Value (NPV) is a tool used in financial management in order to figure out what the value of all cash flows in the future is, at the current moment in time for a given project, such as a capital investment.

It is commonly utilized when it comes to capital budgeting, as it allows management to quickly see which given project would generate the largest level of profit.

For example, if there were three different projects under consideration, the NPV for each of these projects would be calculated, with the project with the highest NPV being the most lucrative choice.

NPV Formula

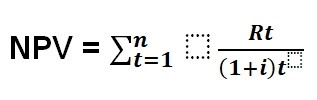

If you are looking to calculate the NPV of a given project, here is the formula for doing so in its most common form:

- Rt = Net cash inflow-outflow in a given period t

- i = Discount rate/Return generated from a different investment

- t = Number of time periods

If your NPV figure is a positive one, this means the projected earnings from this given investment or project will be greater than the planned costs in present terms. Therefore, an assumption can be made that all things being the same that the project will be profitable if there is a positive NPV and it will be loss-making if it is a negative NPV. Therefore, only projects that have a positive NPV value should be considered when it comes to investments.

You do not have to manually calculate the NPV for a given project. There are many calculators, spreadsheets and tables that you can use to do it for you in a quick and accurate manner.

Future Value of Money

Naturally, a sum of money that you have at the present moment in time is going to have more value than having the exact same sum at a future date. This is because of inflation and the money you can generate by investing this present time sum during the intervening period.

Therefore, a dollar that you earn at a future date is not going to be worth the same that you make today. This is why a discount rate is used when you are calculating the NPV of a given project.

Discount Rate

If you were given a choice to get $100 today or $100 in the future then the choice is easy. The $100 today is worth more than $100 in the future. However, if you are faced with getting $100 today or $104 in the future, then a bit more consideration is needed.

If this additional 4% is worth waiting for, then the future sum will be worth your while. However, if you can find a way to invest the $100 today at a rate of at least 4% over the next year, then you will be better off taking the $100 at the present moment. If you know you could earn an 8% return on your $100 over the next year, then this means that the discount rate will be 8%.

A common way for management to determine the discount rate of a given project is through the comparison of the expected return of an investment and the costs it would take to finance this investment. If a project is set to return 10% in a year and the finance costs are 11% or another project would generate a 13% return then this project will be avoided.

A Working Example

In this example, assume the management of a company is looking to make a capital investment in new equipment that will cost them $2,000,000 and it will generate $50,000 worth of revenue monthly for a five year period. The company has the money on hand to make this investment. If these funds were invested in the stock market, it could expect a return annually of 8% and carry the same level of risk.

Initial Investment NPV

As the new equipment is being paid in cash up front, the initial cash flow is part of this calculation and there is no need to discount the capital sum.

Calculating the total periods (t)

There will be cash flow each month for five years, meaning that there are a total of 60 cash flows and periods.

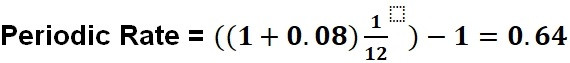

Figuring Out the Discount Rate (i)

The alternative stock market investment would return 8% annually. As the cash flows from the capital project are monthly, the annual discount rate has to be tweaked in the formula to a monthly rate. This yields a discount rate of 0.64%

Future Cash Flows NPV

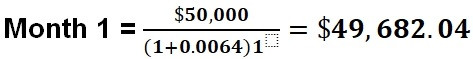

Assume that it will be at the close of the month that the cash flows will be earned and that the first cash flow comes a month after the initial purchase. You have to discount each future payment by using a calculator or spreadsheet.

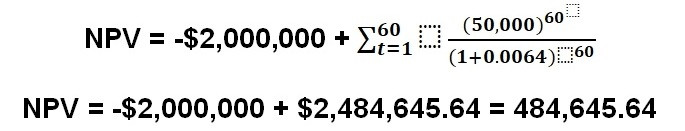

The complete calculation will see you adding together the present value of each future cash flow and then minusing the initial investment.

As there is a positive NPV, that means that the management will go ahead and make the purchase of this equipment. The NPV could be negative if there was a bigger discount rate or the cash flows were not as big and thus the investment would be avoided.

Alternative Methods to NPV

Naturally, with any forecasting formula, there are going to be assumptions that management has to make. Therefore, there is always going to be some margin of error. You need to estimate the likes of projected returns, discount rate and the costs. Through the course of a project, unexpected costs often crop up that then change the NPV of a project.

Sometimes financial management will use the payback period method instead or as well as calculating NPV. This looks at the length of time it will take to repay the original investment through cash flows from the project. As there is no accounting for the time value of money, long term estimates can be a lot more accurate.

There is only consideration also of paying back the initial investment and not considering changes thereafter in the rate of return of the investment. Therefore, it is not a good gauge for profitability in the long run of different investments.

Conclusion

As you can see, NPV is a useful tool for financial management to determine if a project is worth investing in or when deciding between a number of different investment projects.

Avoiding all negative NPV projects is essential if profit-making is the goal. Once management is aware that assumptions have to be made and that forecasts are never going to be exactly precise, this is a useful tool to have in their arsenal.

Recommended Financial Products

Full list of recommended Stock Brokers

Suggested For You

Most Popular Articles

Featured Reviews