How Are Stock Market Indexes Calculated

Contents

- Why stock market indexes are important

- What are the most common stock market indexes?

- The Dow Jones Industrial Average or DJINDICES

- The S&P 500 Index

- NASDAQ Composite Index

- How are the indexes calculated?

- Market cap-weighted

- Equal-weighted

- Price-weighted

- Why you follow stock market indexes

- Final thoughts

As an investor, you can evaluate a couple of different factors to gauge stock performance. When someone refers to a market going up and down, the market is seen through the lens of indexes.

A stock market index refers to a measurement of the value of a stock market or a certain small subset of the market that helps investors compare current prices with past price levels to determine market performance.

Why stock market indexes are important

The daily result of the stock market indexes is probably the most common number cited in the finance and business world. This matters so much to people looking to buy stocks.

The Dow Jones Industrial Average is perhaps the most known and highly followed stock index worldwide. It is comprised of 30 well-known publicly-traded companies in the US.

The S&P 500 is another well-known stock market index. The 500 firms included in the index represent over 70 percent of the total market cap of all the US stocks traded. Additionally, Nasdaq Composite is quite a broad index than consists of around 4,000 shares exchanged on the Nasdaq National Market.

What are the most common stock market indexes?

The majority of stock market investors monitor the performance of the three major stock market indexes discussed below.

The Dow Jones Industrial Average or DJINDICES

This stock market index dates back to the 19th century making it the oldest in the United States.

The index tracks up to 30 stocks that consist of a wide variety of varying market sectors, except transportation and utility companies. Whoever manages the Dow maintains its 30 component stocks unchanged even for years at a time, replacing companies only when required. This is usually a way of maintaining the index’s reputation of including only stocks of top-notch companies.

The S&P 500 Index

This tends to be a broader index than consists of around 500 big company stocks.

The components are replaced much more frequently, as the index pushes to include a representative mix of companies that present the overall U.S economy. Some of the top holdings of this index are Apple, Microsoft, Facebook, Amazon and JP Morgan Chase among others.

NASDAQ Composite Index

This is an index of stocks that are traded on the Nasdaq Stock Market.

NASDAQ is used by investors as a gauge of the performance of the stock market, especially the technology sector. This is because most of the largest and most influential components of the index are tech stocks making up for over 46% of the index value.

However, beyond these common indexes are hundreds of more market indexes. Depending on your needs, you can find indexes that show the performance of stocks in a particular country or that carry out business in a certain sector of the economy.

How are the indexes calculated?

Different stock indexes are weighed using a variety of methods. Each component stock in a certain index includes a weighting assigned to it.

Stocks bearing higher weightings tend to have more influence on the index`s performance than those bearing lower weightings. Below are three common ways by which indexes typically attach weightings to their stocks.

Market cap-weighted

These indexes give more weight to companies boasting higher market capitalization. Companies in both the NASDAQ and S&P 500 indexes are market cap-weighted, and high-end companies like Microsoft and Apple have more weightings than the smaller companies in the same indexes. This implies that these large components can result in a disproportionate impact on the performance of the index.

Capitalization-weighted indexes are more common because the values change proportionally to the price change of each stock. This is because the market cap is usually determined by the stock times the number of shares outstanding. The shareholder base of each stock is also taken into account by the indexes.

Some companies own shares that are not entirely available to the public, and this is the reason why most indexes employ the free-float factor to manage calculations. The free float refers to the percentage of the stocks available for trading.

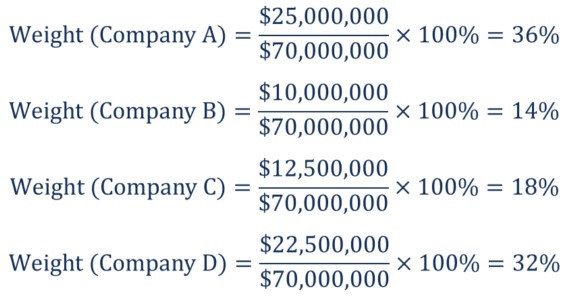

A capitalization-weighted index consists of 4 companies only: Company 1, Company 2, Company 3 and Company 4. The summary of the index`s current share price and the total number of the share outstanding is as shown below:

Market capitalization can be calculated from the information on the table above using the following formula.

Market capitalization = Stock Price x Number of shares

Once you find the market capitalization of each company, then you can calculate the total market capitalization of the index through the sum of the market cap of all the components.

To get the weight of each index component, use the formula shown below:

Equal-weighted

More equal-weighted indexes have joined the scene in recent years. In an equal-weighted index, all its stocks are weighted equally regardless of a certain stock`s market capitalization or relative price or any other factor. The price change of an equal-weighted index is based on the return percentage of each of its stock.

For example, assume there are 3 stocks in your equal-weight index: ABC, PQR, and XYX. Regardless of the number of shares you own for each stock or the exact trading price, you look at the percentage of price performance. So, if stock ABC is up 50 percent and PQR is up 10 percent and XYZ is up 15 percent, your index is up 25 percent = (50+10+15) / 3. This represents the number of stocks in the index.

The calculation is done based on an arithmetic average, but the geometric average can also be applied in some equal-weight indexes. In such a case, the formula would be (1.5+1.1+1.15) (1/3). The geometric formula will produce a slightly lower percentage but still should be relatively close to the arithmetic formula.

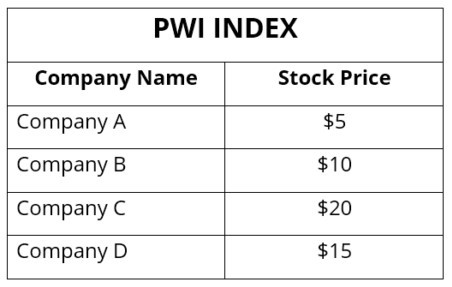

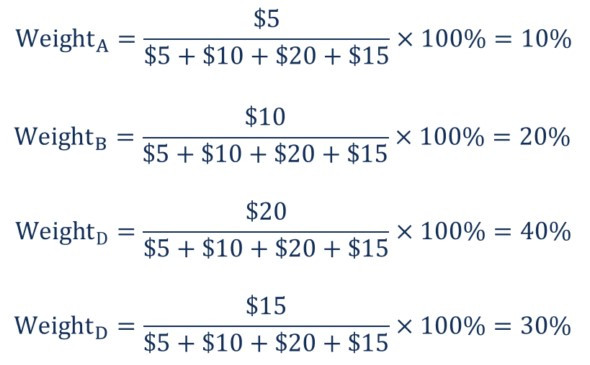

Price-weighted

An example of a price-weighted index is the Dow Jones Industrial Average. This index gives more weight to companies bearing higher stock prices. As an example, in an index comprising of 3 stocks with share prices of $20, $70 and $20, the $70 stock would make up for 0 percent of the total index regardless of the company’s relative size.

Here’s another example.

Suppose you have two stocks, Stock 1 going for $20 for each share and Stock 2 going for $40 each share. A price-weighted index will allocate a bigger proportion of its composition to the stock at $40 than the stock at $20. Therefore, if your index is comprised of these two stocks, the index number would show the $40 stock as two-thirds of the number (67 percent) and the $20 stock as one-third of the number (33 percent).

Why you follow stock market indexes

Stock market indexes are beneficial for several reasons:

- Monitoring the most common indexes can offer you a general sense of the performance of the entire stock market

- Monitoring the lesser known indexes can be of great help when it comes to comparing the performance of a particular segment of the stock market to another

- If you aren’t comfortable investing in individual stocks and would rather match the performance of the overall stock market, then investing in index funds that monitor the indexes you`re most interested in can be the most cost-effective option to earn a solid return over time.

Final thoughts

A stock market index will make it easier for you to know the health of the market without having to monitor the ups and downs of each individual stock. Now that you know how stock market indexes are calculated, it’s time to put your best foot forward and find the best stock index to invest in.

Recommended Financial Products

Full list of recommended Stock Brokers

Suggested For You

Most Popular Articles

Featured Reviews