Introduction

E*Trade started in 1982 and they conducted their first online trade the following year. They went public in August 1996, with their headquarters being in New York City. They currently have more than 4,100 employees and they have 30 retail branches around the United States.

They are one of the leading financial services companies in the space and were one of the pioneers of online brokering. They have long been involved with digital innovation, constantly being on the lookout for the next advancements they can make to take their offering to the next level.

They currently have more than 3.6 million customers globally, providing them with two proprietary platforms to choose from when trading which are looked at in this E*Trade broker review.

Overall Rating

Pros

-

Account Options

There is a wide variety of different account options and you can choose which one fits your specific needs the best

-

Quality mobile offering

E*Trade has always been an innovative broker and for many years they stood out from their competitors with their top quality mobile offering. While others are catching up, this is still an excellent offering.

-

Strong trading platforms

There are two proprietary trading platforms available at E*Trade and both of them tick all of the boxes when it comes to researching and trading securities and options.

-

Quality research and data

There research and data offerings are free and wide ranging. This means that you can conduct most of your resource through the E*Trade platform’s offering and not have to pay for additional services.

Cons

-

Commissions slightly high

While E*Trade are on par with their competitors in a lot of areas of commissions and fees, the likes of Fidelity and Charles Schwab have flat trade commissions that are $2 cheaper.

-

Barrier to entry for Pro platform

To access this trading platform, you either need to meet the active trader requirements, hold $250,000 of assets in your account or pay $90 each month.

E*TRADE is a financial services company that provides online brokerage and related products and services primarily to individual retail investors.

Commissions & Fees

E*Trade is competitive when compared with the other significant full service brokers like Charles Schwab, Fidelity and TD Ameritrade. There are other brokers out there with cheaper rates, but there is a quality offering at E*Trade that is worth the extra fees and commission you will be paying.

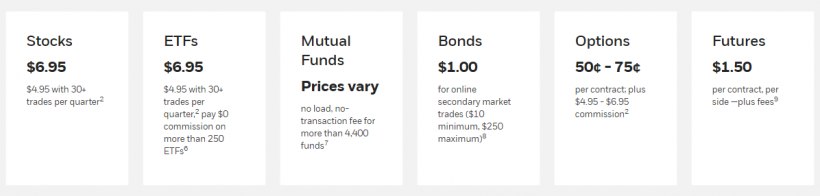

A stock trade will cost you $6.95 and there is an additional charge of $0.75 per options contract if you are trading options. If you have a short position that has a price of $0.10 or less, then this will be free.

You can get a discount if you are an active trader, making at least 30 trades in a quarter, you will have a reduced commission level of $4.95 and a $0.50 charge per contract. Their mutual fund commission are less than those at their competitors. Charles Schwab and Fidelity do have slightly lower based commissions for stock trades at $4.95 compared to the $6.95 at E*Trade.

Platform & Tools

E*Trade mainly rely on proprietary trading software. Their MarketCaster system allows you to keep track of your holdings and highlighted sticks in an easy way. There are two trading platforms on offer at E*Trade.

The E*Trade Pro platform is a desktop based platform and you need to be an active trader in order to access it or else your portfolio needs to be worth at least $250,000. If you do not meet these requirements, then you will have to pay $99 a month to use it.

It does have all of the features you could want, especially if you are an active trader. It has more than 120 technical indicators and 31 different drawing tools.

Their other trading platform is called OptionsHouse and it is web based. This software was part of the OptionsHouse broker when E*Trade acquired the company for $725 million in 2016. It is one of the best trading and research platforms in the industry.

It is very easy to use, fast and provides all the tools an options trader would ever need. It is even well suited for beginners. It’s not just for options trades either; you can also trade equities and futures.

Mobile App

Keeping in line with their streak of innovation E*Trade were the first broker to put an emphasis on mobile trading. Between 2013 and 2016 they cleaned up on this front, with none of their competitors getting near the quality of the E*Trade mobile platform.

While in the last few years their competitors have started to catch up, E*Trade still have a quality mobile trading experience. There are two different mobile options, with E*Trade Mobile and OptionsHouse Mobile being available to users.

Both apps are very easy to use and have a myriad do features. One of the areas they fall down in is the amount of indicators available as part of the mobile offering. There are only ten available as part of E*Trade Mobile in comparison to the current industry average of 36.

If you want to sue any of the features associated with E*Trade Pro through the mobile app, you already need to have access to the desktop trading platform.

Account Types

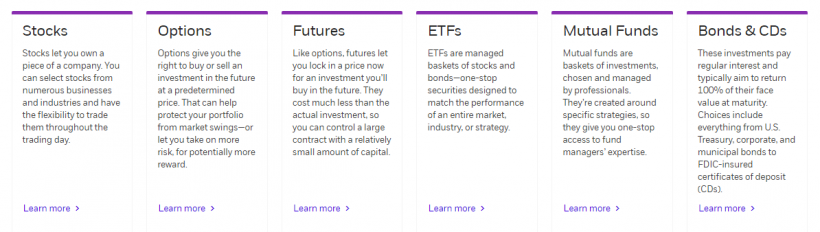

There are many different account types available as part of E*Trade. The standard brokerage accounts allow you to access their full range of investment products, as well as wide ranging forms of research, analysis and education.

You also get 60 days’ worth of commission-free trading. They also provide you with savings accounts, custodial accounts, retirement accounts etc. If you prefer to take a hands off approach to your investing, you can sign up for one of E*Trade’s managed portfolios.

There are four choices as part of the managed portfolio option. You can choose from Core Portfolios, Dedicated Portfolios, Fixed Income Portfolios and Blend Portfolios. There is a $500 account minimum in place for all accounts except IRA accounts.

Deposits & Withdrawals

There are numerous ways in which you can make a deposit to your E*Trade account. You can set up an electronic transfer which will take up to 3 business days in order to process. The procedure of setting up this transfer method will only take about five minutes.

You can also make a direct wire transfer from your bank account. This will process on the same business day as when you request a deposit. If you want to transfer an account from a different broker, this will take at least ten business days to complete. You can make a deposit by cheque. This can be done through a mobile deposit system or by sending it by mail. This will take up to five business days to process.

There are similar methods in place for you to make withdrawals from your account. You can use the ACH transfer system that can take as long as three working days for your funds to process. You can use a wire transfer, with a fee in place of $25.

Additionally, if you are making a withdrawal into a foreign currency, there is a forex fee of as much as 2.25% that needs to be considered. You can use a debit card to withdraw funds. If you are looking to move your account to a different broker, it can be done through the ACAT system. This will cost $75 in addition to any charges the receiving broker may have. You can also make a withdrawal through cheque.

Customer Support

E*Trade has a good customer support team available to help you with your needs. As there are 30 physical branches across the United States, you can deal with the team in-person if that is easier for you. You can also get in touch with a member of the team on a 24/7 basis. This is done through live online chat, email or by phone.

Their team is well trained and they are able to quickly resolve and any issues or queries that you may be experiencing. There is also a comprehensive FAQ section on the E*Trade website that will answer a lot of questions that you may have.

Security & Fairness

As per the SEC Customer Protection Rule, all customer securities that are fully paid will be 100% in the ownership of the customer. They are kept in segregation from the assets of E*Trade. This means that in the case of insolvency, customer assets cannot be used to pay off company debts.

They are also a member of the SIPC which means that users will have their securities worth up to $500,000 covered, as well as $250,000 worth of cash protected. This helps protect customers in case the broker-dealer they are using fails.

In addition to these measures, E*Trade also has additional insurance protection. This will see a fund of $600 million being available to pay off obligations outside of the SIPC limits. The max amount of cash any one customer can receive as part of this protection is $900,000.

E*Trade is also committed to ensuring the privacy and protection of your data. They have comprehensive fraud protection, payment protection and privacy protection. You can engage in their digital security ID program which means that it is practically impossible to have someone unauthorized log into your account. Finally, you will receive smart alerts of all account activity and all transactions through your mobile device and email account.

Suggested For You

Compare E*TRADE

Find out how E*TRADE stacks up against other brokers