Introduction

The eToro online trading platform is well known in the online trading industry as the platform that changed the way retail traders trade the financial markets. Established in 2006 by 2 siblings Ronen and Yoni Assia together with their business partner David Ring, eToro single handedly revolutionized the concept of social trading with the introduction of their Openbook social trading platform in 2010.

Since then, eToro has expanded by leaps and bounds with the acceptance by traders of the idea of harnessing the collective wisdom of the trading community to improve their trading objectives. Since 2017, eToro has achieved more than 8 million registered users on its trading platform.

Today, the eToro brand is managed by different subsidiaries of the eToro Group. For clients in the UK, they are serviced by eToro (UK) Ltd, a company registered with the UK’s FCA with the registration number FRN 583263. For clients based in the European Economic Area (EEA), they are serviced by a Cyprus based company called eToro (Europe) Ltd. The company is authorized and regulated by the Cyprus Securities Exchange Commission (CySEC) under the CIF license # 109/10. For the Australian market, eToro operates under the subsidiary eToro AUS Capital Pty Ltd which is regulated by the Australian Securities and Investments Commission (ASIC) under the license number 491139.

Overall Rating

Pros

-

Regulated by ASIC, CYSEC & FCA

eToro comes under the regulatory oversight of 3 different leading financial regulatory bodies namely the Financial Conduct Authority, Cyprus Securities Exchange Commission and the Australian Securities and Investments Commission.

-

Intuitive Friendly platform

The proprietary CopyTrader™ trading platform is one of a kind in the industry and is extremely easy to use.

-

Innovative Products such as CopyPortfolios

eToro is the first broker in the industry to offers retail traders a new generation of investment products called copyportfolios.

-

Free Daily Market Analysis

A free market analysis is provided by eToro’s in house analysts on a daily basis.

Cons

-

High Fees

The fees charged by eToro are higher than the market average.

-

No choices of trading platform

eToro does not have any other trading platform available except its proprietary Copytrader trading platform.

With numerous successful traders using our platform to share their strategies, eToro clients have everything they need to pursue their financial goals.

Commissions & Fees

eToro offers its traders a simple fee structure. Traders do not have to pay any commissions on the trades that they make. Instead, they are required to pay a small spread on top of the Bid/Ask price. The spread varies from assets to assets and change according to the market conditions. Nevertheless, the spreads are fixed hence enabling traders to have a more accurate picture of their overall trading cost before they execute a trade. While eToro is able to offers its traders more certainty on their trading costs, the spreads charged by the broker are higher than what most leading brokers are offering to their clients. For example, the benchmark EUR/USD spread at eToro is 3 pips. The table below shows some of the typical spreads that you would expect for the frequently traded currency pairs:

|

Currency |

Spreads |

|

CAD/CHF EUR/HUF EUR/NOK EUR/PLN EUR/SEK EUR/USD GBP/CAD GBP/HUF GBP/USD NOK/SEK NZD/USD USD/CAD USD/HUF USD/MXN USD/NOK USD/PLN USD/SEK USD/SGD USD/TRY ZAR/JPY |

4 Pips 20 Pips 20 Pips 30 Pips 30 Pips 3 Pips 4 Pips 30 Pips 4 Pips 20 Pips 5 Pips 3 Pips 20 Pips 20 Pips 20 Pips 20 Pips 20 Pips 3 Pips 50 Pips 8 Pips |

Apart from the spreads that traders have to pay on their trades, traders at eToro are subjected to a monthly fee of $10 for accounts which are inactive for more than 12 months.

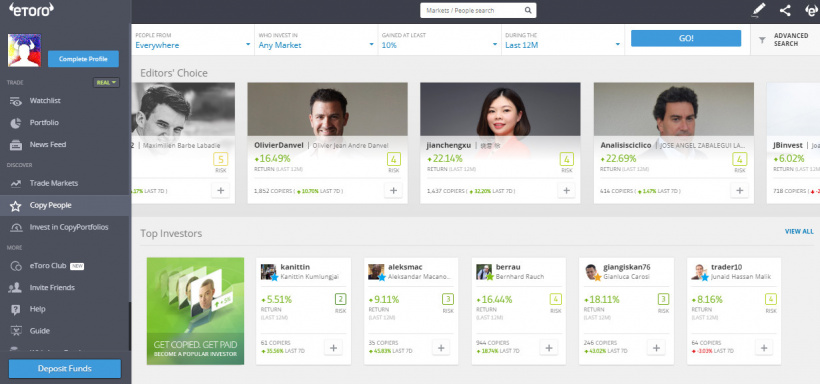

Platform & Tools

One of the main features of eToro draws many traders to it, is its trading platform. Unlike most broker in the industry which uses a generic trading platform supplied by a 3rd party, eToro uses a proprietary web based trading platform. The platform called the ‘CopyTrader” has been developed from the “Openbook” trading platform first introduced in 2010. With the newly upgraded CopyTrader platform, traders at eToro now can engaged in copytrading and independent trading from a single login. The CopyTrader is extremely user friendly and comes with powerful trading features. It also comes with an advanced charting package designed to make trading easier.

The chart supports multiple time frames and comes with sophisticated trading tools such as technical indicators which you can use to help you optimize your trading activities.

Mobile App

While the web based copytrader can also be accessed by smartphones through a web browser, eToro has also made an effort to provide smartphone owners with a dedicated mobile trading app. The mobile trader is available free of charge and can be downloaded from Apple App Store or Google Playstore depending on your smartphone phone operating system. The mobile app is optimized for the small screen of the smartphones and comes with all the key features of the web based version. You can check your trading account, make trades and keep up with all the latest developments in the market through the mobile trader.

Account Types

As a financial services provider operating in a multi-regulatory environment, eToro is required to abide by certain regulations requiring it to distinguish between retail traders and professional traders. In order to comply with this regulatory requirement, eToro offers two types of trading accounts, a standard account for normal retail traders and a professional client account. The key difference between these 2 types of trading accounts is the leverage ratio. For the standard account, the leverage ratio is restricted. In addition, they also enjoy the benefits of negative balance protection and margin closeout restrictions. For professional clients account, the leverage ratio offered by eToro is as high as 1:400.

For potential traders of eToro, the broker also offers a demo account preloaded with $100,000 which they can use to test out the trading platform first before committing any real money. The good thing about the demo account is the fact that it is free and has no limited time frame for its access.

Deposits & Withdrawals

Understanding that their clients come from different locations around the world, eToro has made it convenient to deposit or withdraw funds by supporting a wide selection of payment methods. These methods can be classified into the following:

- China Union Pay

- Credit and Debit card

- Giropay (Sofortüberweisung)

- Local Online Banking

- Neteller

- PayPal

- Skrill Limited

- WebMoney

- Wire Transfer

- Yandex

The fastest methods of depositing funds are by means of the credit card, China UnionPay and through local online banking. Wire transfer is the most time consuming as it can take up to 5 business days before a transaction is cleared.

For withdrawals, eToro only support the following 3 methods:

- Bank wire transfer

- Credit/Debit cards

- PayPal

It should be noted that withdrawals are subjected to a withdrawal fee of $25. In addition, you are also required to shoulder the currency conversion fee ranging from 50 pips to 250 pips. For cryptocurrency transfers, the following fees are applicable:

|

Cryptocurrency |

Fee |

|

BTC ETH XRP |

0.0005 Units 0.006 Units 0.25 Units |

Customer Support

As for the customer support service at eToro, traders can contact the support team through email, fax or the telephone. Unfortunately, there is no live chat support available. Other ways which eToro supports its clients is by providing them with extra trading tools such as an Economic Calendar, Earnings Report Calendar and daily market reviews. The broker also has a fairly comprehensive trading academy which beginner traders can access to beef up their trading knowledge. In the trading academy, traders can access educational resources in the form of:

- eCourses

- Live Webinars

- Trading videos

Security & Fairness

As a broker that is regulated in 3 key jurisdictions around the world, eToro is able to offer its clients the peace of mind that their funds will be safe with this broker. In addition, they are also accorded extra protection under schemes such as the Investor Compensation scheme (Cyprus) and the Financial Services Compensation Scheme (UK).

Although the fees charged by eToro are higher than the industry average, it should be noted that the bulk of the traders that flock to eToro are not deterred by the higher than average fees. This is due to the fact that eToro is able to offer them a reliable and safe environment with which they can engage in social trading. In addition, the broker also offers those with higher trading skills to profit from other traders who are copying their traders through eToro’s “Popular Investor” program. Under this program, a top investor with a large following of copiers will be able to earn a commission on each trade that the copier made while following the investor trader. Our conclusion then is that eToro is a dependable and reliable broker especially for beginner traders.

Suggested For You

Compare eToro

Find out how eToro stacks up against other brokers