Introduction

Since 1975, TD Ameritrade (AMTD) has led the brokerage industry in providing innovative offering and excellent services to a variety of clients and investors. Although it incurs higher costs such as $6.95 for a stock trade and $6.95 + $.75 per contract for option trades, AMTD’s comprehensive range of tools and platforms and exceptional customer service more than make up for the pricey fees. The firm has no minimum investment required as well as a maintenance fee, and offers free trading for 60 days for clients with deposit of $3,000 or more.

TD Ameritrade, a publicly traded online brokerage firm, has been servicing over 11 million clients with a total value of more than $1 trillion in assets. This figure is catalyzed by approximately 500,000 trades done on a daily basis and is supported by custodial services for over 6,000 independent registered investment advisors. Hence, AMTD has been consistently recognized by numerous bodies and institutions for ensuring a great holistic experience for its clients and investors.

Overall Rating

Pros

-

Free Use of Platforms

Clients and customers can access and utilize all trading platforms for free without an account or trade minimum.

-

Connected Platforms

Regular synching between its web-based (Trade Architect), desktop (thinkorswim), and mobile (TD Ameritrade Mobile and TD Ameritrade Mobile Trader) trading platforms

-

Sophisticated Features

Include Heat Maps, Social Signals, Federal Reserve Economic Data (FRED) Analysis, Integrated Watch Lists, Virtual Trading Simulator (paperMoney), and myTrading Community

-

An Extensive List of Products

Such as Trade Stocks, Bonds, Mutual Funds, ETFs, Options, Futures, Forex, Foreign ADRs, and IPOs for qualified accounts

-

Commission-Free Products

Offers more than 300 commission-free ETFs and thousands of no-transaction-fee (NTF) Mutual Funds

Cons

-

Above-average Commissions

Costly stock and options commissions

-

Margin Rates

High margin rates at majority of the dollar levels

-

Security

Does not have two-factor authentication and other up-to-date security features

TD Ameritrade has served as a pioneer and staple name in the industry due to its innovative offerings and services to diverse clients and investors, across various levels.

Commissions & Fees

The firm incurs a flat rate of $6.95 per stock trade, and an option base fee of $6.95 plus $0.75 per contract. This puts them on an equal footing with E*TRADE and Merrill Edge. However, TD Ameritrade charges higher fees on mutual fund trades and broker-assisted trades compared to the cited firms. It also offers over 300 commission-free ETFs and thousands of no-transaction-fee (NTF) Mutual Funds which continuously satisfy over 11 million clients.

Although other competitors such as Charles Schwab and Fidelity offer lower trading fees, clients and investors still choose TD Ameritrade because of its in-depth research and analysis, advanced platforms and tools, and extensive investor education and guidance.

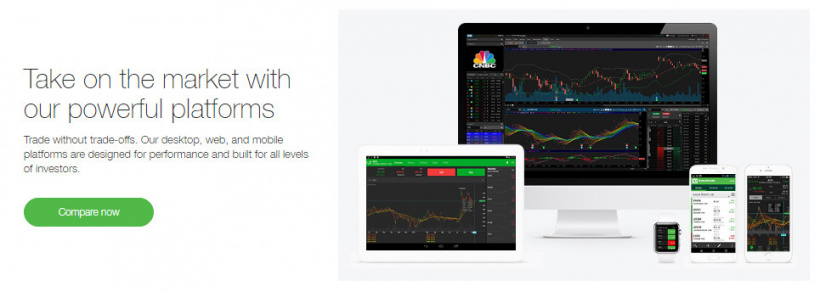

Platform & Tools

Customers can access their TD Ameritrade accounts through three main channels, namely, web, web-based, and mobile. The web trading platform (tdameritrade.com) is the most basic channel which features customizable alerts, screeners, third-party studies, social pulse, and instructional materials. There is also Trade Architect, a web-based platform, which is designed for casual investors. TD Ameritrade has made available thinkorswim, which runs as a desktop application, for professional-level investors that are interested in making use of advanced earnings analysis, social sentiment insights, Federal Reserve Economic Data (FRED), historical markets data, economic and corporate calendars, and real-time stock scans. In addition, it has two mobile-based platforms that automatically sync with the aforementioned platforms.

Mobile App

TD Ameritrade hosts two mobile application, namely, TD Ameritrade Mobile and TD Ameritrade Mobile Trader. Both apps can be opened through iOS and Android devices. TD Ameritrade Mobile is well-suited for novice and causal investors because of its functionality that is comparable to the web-based platform, as well as its ability to provide Level II quotes. On the other hand, TD Ameritrade Mobile trader is designed for advanced active traders as the app automatically sync with the thinkorswim platform, thereby enabling the seamless management of stocks, options, futures, and forex. Consumers can enjoy advanced charting and order entry, voluminous objective research, and insightful commentary and insights on relevant market news.

Account Types

The firm enjoins clients to open their brokerage accounts in five major categories:

- Standard

- Retirement

- Education

- Specialty

- Managed Portfolios

TD Ameritrade continues to garner a large share of the market size because they do not require a minimum deposit to open any of these accounts.

Deposits & Withdrawals

Customers can finance their TD Ameritrade account/s in a handful of ways. These include electronic bank deposit, wire transfer, and check. The firm also allows the transfer of securities (e.g., stocks, options, ETFs) from external accounts to the TD Ameritrade account, and the use of physical stock certificates to deposit funds.

Account holders seeking to withdraw can utilize the firm’s Cash Management facility, which allows clients to use debit cards provided by TD Ameritrade for withdrawals, as well as write checks. Nevertheless, it should be underscored the TD Ameritrade account does not have FDIC insurance and is not bank guaranteed. Thus, account holders are also encouraged to link their TD Ameritrade and TD Bank accounts to transfer funds conveniently.

Customer Support

TD Ameritrade has a 24/7 phone support with dedicated lines for Spanish-, Cantonese-, and Mandarin-speaking customers. Questions regarding products, tools, and services can receive automated responses through the Ask Ted Button at the top of any page within the various platforms. Other feedback mechanisms include email, fax, text, secure messaging, and Facebook messenger. Further, clients can visit one of TD Ameritrade’s over 360 branches nationwide for face-to-face support. Accessibility services such as sign language, oral interpreter services, and telecommunications relay are likewise available.

Security & Fairness

In general, TD Ameritrade is regulated by FINRA, and its customer accounts have both FDIC (deposit accounts at TD Bank) and SIPC protection. It also has put up several layers of protection in case of insolvency. The firm’s own Asset Protection Guarantee ensures the reimbursement of any cash or securities lost by a client due to unauthorized activity. At the platform level, the provision of two-factor authentication and other modern security features may help in fortifying existing security measures.

As for fairness, TD Ameritrade compensates for its above-average commission by providing its clients with excellent services and product range. The broker also provides free research and as well as reliable trading platforms. In other words, you get your money worth.

Suggested For You

Compare TD Ameritrade

Find out how TD Ameritrade stacks up against other brokers