Introduction

Founded in 2010, 24Option is a leading online brokerage that offers online forex and CFDs trading services to its clients. The 24Option brand was established with the goal of providing online traders with an easy to use trading platform. The brand is managed by two different companies, Rodeler Ltd based in Cyprus and Richfield Capital Ltd based in Belize. In addition, 24Option has also endeavored to provide its clients with a wide range of financial instruments to trade with. The types of financial instruments covered by 24Option include the following:

- Commodities

- Cryptocurrencies

- Forex

- Indices

- Stocks

The choice of these financial instruments are carefully selected by 24Option in order to cater to a global clientele. Hence, it is not surprising for you to be able to trade in major stocks that are listed on leading exchanges such as the FTSE, NASDAQ and London Stock Exchange. Access to these assets on 24Option is through the web based trading platform or the popular MetaTrader 4 (MT4) trading platform developed by MetaQuotes Software. For a better insight into what 24Option has to offer, let us take a look at the 24Option review below.

Overall Rating

Pros

-

Regulated in two Jurisdictions

Operating under 2 different subsidiaries, 24Option is regulated in Belize and Cyprus.

-

Choices of 2 types of Trading platforms

24Option offers its clients a proprietary web based platform and the MetaTrader 4 platform.

-

4 Types of Trading Accounts

Traders of different levels of trading experience will be able to choose the type of trading accounts that suit their trading needs.

-

Comprehensive Educational Center

There is an abundance of trading educational resources provided by 24Option.

Cons

-

Uncompetitive Fees

Comparatively, the fees charged by 24Option are higher than the industry average.

-

Modest Selection of Trading Assets

Despite being operational since 2010, 24Option coverage of the financial markets is still rather limited.

Your success is a testament of our commitment to any investor who chooses to trade with 24option. That is why we strive to provide you with an expanding asset selection, dedicated support and personal assistance.

Commissions & Fees

In terms of trading fees and commission, 24Option does not charge its traders any commission. Instead, they have to pay small spreads on the trades that they have executed on 24Option’s trading platform. The spreads which 24Option imposes are floating spreads. They vary according to the type of trading account which the trader is trading from. The table below is indicative of the spreads which traders at 24Option can expect from the broker:

|

Basic Account |

Gold Account |

Platinum Account |

VIP Account |

|

CRUDE OIL ($0.08) EUR/USD (2.3 PIPS) GBP/USD (2.5 PIPS) GOLD ($0.59) |

CRUDE OIL ($0.06) EUR/USD (1.8 PIPS) GBP/USD (2.2 PIPS) GOLD ($0.49) |

CRUDE OIL ($0.05) EUR/USD (1.4 PIPS) GBP/USD (1.6 PIPS) GOLD ($0.39) |

CRUDE OIL ($0.05) EUR/USD (0.9 PIPS) GBP/USD (1.1 PIPS) GOLD ($0.22) |

* The figures are obtained directly from the 24Option’s website at the time of this review.

Apart from the spreads that traders have to pay on the trades executed on the 24Option’s trading platforms, traders are required to pay a monthly maintenance fee of 10 EUR regardless of whether the account is active or not. For inactive accounts, 24Option charges its clients an Account inactivity fee if the account is inactive for more than 2 months. The following table below shows the inactivity fees that 24Option imposes on inactive accounts:

|

Inactivity period |

Inactivity Fee(Per Month) |

|

0 to 2 months |

0 |

|

2 to 3 months |

€80 |

|

3 to 6 months |

€120 |

|

Over 6 months |

€200 |

Platform & Tools

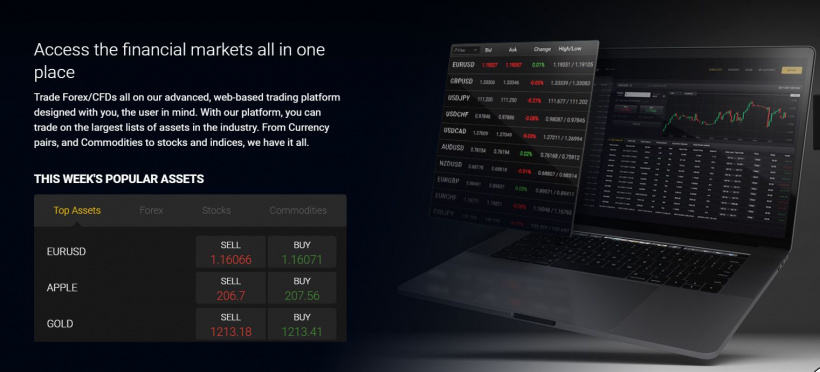

Traders at 24Option have a choice of two different types of trading platforms to access the financial markets with. For traders who want to trade the financial markets without downloading and installing any software, they can use the proprietary web based trading platform supplied by 24Option.

The WebTrader is user friendly can be easily accessed with any updated web browser. The platform also comes with a fairly sophisticated trading chart.

MetaTrader 4 Trading Platform

In addition to the 24Option WebTrader, 24Option has also provided its clients with the MetaTrader 4 (MT4) platform. The MT4 is the online industry’s most popular trading platform and is well liked by traders all over the world. It comes with numerous trading tools built into the platform itself. For example, it features an advanced charting package with a large library of technical indicators. In addition, the charts can support multiple time frames. Other features of the MT4 platform include its ability to support multiple order types and automated trading.

Mobile App

In addition to the main trading platforms mentioned above, 24Option has also made available mobile optimized version of the WebTrader and MT4 trading platforms. Both these trading platforms can downloaded from Google Playstore and Apple App Store.

Account Types

For trading accounts, 24Option offers 4 different types of trading accounts to cater for different category of traders. They are the basic account, the Gold account, the Platinum account and the VIP account. The features of the various trading accounts are as follows:

Basic Account

Minimum Deposit Requirement $250

1x Free Basic Trading Orientation Session

100% Margin Call

1x Free Withdrawal

Access to Trading Central

Free Daily News feeds

Leverage: 1:500

SMS Signal Alert

Gold Account

Minimum Deposit Requirement $5000

100% Margin Call

1x Monthly Withdrawal

2x Free Basic Trading Classes

Access to Trading Central

Free Daily News feeds

Leverage: 1:500

Monthly Webinar

SMS Signal Alert

Platinum Account

Minimum Deposit Requirement $10,000

100% Margin Call

2x Monthly Webinars

3x Free Advanced Trading Classes

3x Monthly Withdrawal

Access to Trading Central

Free Daily News feeds

Leverage: 1:500

SMS Signal Alert

VIP Account

Minimum Deposit Requirement $50,000

100% Margin Call

5x Free Advanced Trading Classes

5x Monthly Webinars

Access to Trading Central

Free Daily News feeds

Free Withdrawals

Leverage: 1:500

SMS Signal Alert

Deposits & Withdrawals

Clients of 24Option have 3 main methods of making a deposit or a withdrawal from their trading account. These methods include bank wire transfers, credit card transfers and electronic payment methods. For bank wire transfers, the minimum deposit amount should be at least $1000/€1000 or equivalent in local currency. For credit card transfers and eWallet transfers, the minimum deposit amount is $250/€250 or equivalent in local currency.

It should be noted that 24Option charges its clients a withdrawal fee of $35/€35 for the basic, gold and platinum accounts above the free withdrawal offer. Other charges which traders at 24Option might to pay when making a withdrawal are as follows:

- Credit Card: 3.5% of the amount withdrawn

- Neteller: 3.5% of the amount withdrawn

- Skrill (Moneybookers): 2% of the amount withdrawn

- Wire fee: $35 / €35EUR / ₤35/ ¥4,000

Customer Support

There are 4 ways to reach out to the customer support team at 24Option, email, live chat, web contact form and the telephone. For telephone support, localized support is available in several major countries such as Singapore, Malaysia, UAE, Russia, South Africa, Brazil and New Zealand.

Security & Fairness

As for the security offered by 24Option, the broker has adopted international best practices to protect its servers from unauthorized intrusion. 24Option uses the latest encryption technology to ensure that the integrity of its clients’ personal data is not compromised. In addition as a regulated entity under the Cyprus Security Exchange Commission (CySEC), 24Option has demonstrated that it is MiFID compliant. And one of the regulatory requirements which 24Option has to abide by is being a member of the Cyprus’ Investor Compensation Scheme. Under this scheme, should ever 24Option become insolvent; its clients’ funds are covered under the scheme to a maximum amount of €20,000.

While the fees imposed by 24Option might be slightly higher than the industry average, we found that it has not affected the integrity and professionalism of this broker in any manner. To date, the broker has acted ethically and professionally. It has also been transparent with its dealings with its clients.

Suggested For You

Compare 24option

Find out how 24option stacks up against other brokers