Introduction

Swissquote was started back in 1996 and it is a publicly-traded company in Switzerland. The offering provides you with a great selection of a variety of different tradable asset classes. Swissquote is affiliated with the leading Swiss banks.

There are two different aspects to the company. There is the CFDs and forex offering that is based in the UK. Then there is the Swiss arm for futures, options, funds and stocks trading.

Swissquote is regulated by the likes of the Financial Conduct Authority (FCA) in the UK and the Swiss Financial Market Supervisory Authority (FINMA). Therefore, you know you are dealing with a safe and fair broker. This Swissquote broker review looks at all the different aspects that make this broker what it is today.

Overall Rating

Pros

-

Well-regulated

Swissquote is regulated by respected authorities across the world, giving traders peace of mind

-

Large selection of assets

There are thousands of different tradable instruments available to you through the Swissquote offering.

-

Variety of trading platforms

There are a number of trading platforms that specialize in different areas of trading that you can use.

-

Many account types

There are a multitude of different account types, allowing you to pick one that fits your needs.

Cons

-

Fees are a tad high

Across the board, Swissquote’s fees are a bit higher than most brokers in the space.

-

No 24/7 support

The customer support lines at Swissquote are only open from Monday to Friday.

Swissquote is not a typical Swiss bank. Our history, ambition and DNA comes from the world of creativity, software development and the empowerment of investors. These values still remain central to Swissquote.

Commissions & Fees

For the most part, Swissquote has somewhat competitive trading fees. The fees will differ depending on if you are using the UK entity to trade or the Swiss-based entity. For the UK offering, you can gain discounts on trading fees if you deposit at least £10,000 and you are an active trader. There is a commission in place of £5 for a round trade, with the spreads generally being pretty low. The average spread cost for EUR/USD is 1.3 pips, which is about average for the sector.

For ETFs and stocks, the commissions are a lot higher than competitors, with commission on US stock being £25 for example. ETF fees scale depending on the size of your trades, with trades worth £0-£500 costing a trading fee of £15. Crypto fees also get lower the more you trade, with commission starting at 1%.

There are no inactivity fees in place when using Swissquote and you can utilize the robo-advisory service if you wish, with the fee being quite high, starting at 0.6% annually.

Platform & Tools

For those who are looking to trade stocks with Swissquote, you will likely use the eTrading platform. This is a proprietary platform that is very intuitive to use, albeit looking to be a bit outdated.

There are ways to customize the experience to your needs, as well as having a number of different languages. There are just four different order types on offer; limit, market, stop and stop limit. There are news and price alerts that you can activate.

Advanced traders will have access to the Advanced Trader platform that is fully stocked up with all sorts of advanced tools preferred by professional traders.

Swissquote has a derivatives trading platform called Swiss DOTS which will allow you to trade more than 70,000 OTC derivatives. The Themes Trading offering provides you with insights into different investment themes. For forex traders, the industry-standard MetaTrader4 platform is available for you to use on Swissquote. This has a wide range of research and analysis tools that will get the job done.

Mobile App

Each of the desktop trading platforms on offer at Swissquote are also available for mobile use. Each option can be used on both Android and iOS devices in a variety of languages. The eTrading app is easy to use but the navigation system can be a bit clunky.

The search function has been largely simplified, but you still have access to all the same order types. Naturally, the MetaTrader 4 mobile app will perform strongly, with most features from the desktop offering making it over to the app. This allows for the fast execution of trades when you are on the go.

Account Types

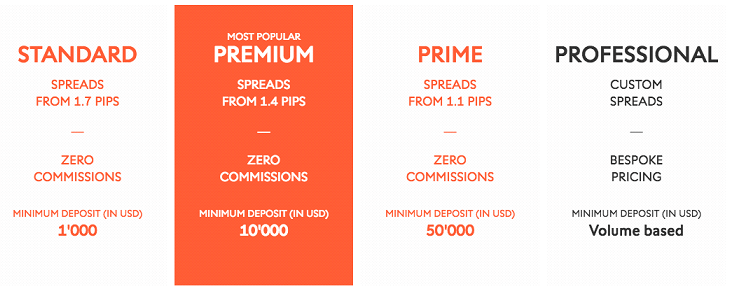

There are different account types depending on if you are using the Swiss or the UK entity. For the Swiss option, there is a trading account (no minimum deposit), four separate forex accounts (Standard, Premium, Prime and Professional) with the lowest minimum deposit being £1,000 for the standard account. Finally, there is a robo-advisory account that has a high minimum deposit, starting at around £10,000. Certain products will have leverage available for you to use.

For the UK entity, there are four types of forex trading accounts. These are Premium, Prime, Elite and Professional accounts. Their minimum deposits, spreads, commissions and leverage amounts will vary depending on the account you choose.

Deposits & Withdrawals

With Swissquote, there are three main base currencies that you can use for the trading account, with the forex and CFD account catering for 15 different base currencies. The Swiss entity charges a deposit fee of up to 2.5% on debit card or credit card transfer fee. No such fees are in place for the UK entity. You have the option to also deposit via bank transfer to these platforms. Funds will deposit within an hour if you use a card option.

There are withdrawal fees for the Swiss entity, varying depending on what country you are based in. You do not pay any such fees for the UK entity accounts. You can only make withdrawals through bank transfer, with this taking about a day for the funds to hit your account.

Customer Support

The Swissquote website is a bit tricky to use, with the navigation system not being very clear. However, there is an FAQ section you can check out. Otherwise, you can contact the support team via email, live chat or by phone. The support team generally is pretty knowledgeable when it comes to the phone and email options.

The live chat feature is best used for very basic issues. Multiple languages are offered by Swissquote customer support. There is currently no 24/7 support, with these lines being open from 8 AM until 10 PM CET from Monday to Friday.

Security & Fairness

As Swissquote is mainly regulated by the FCA in the UK and the FINMA in Switzerland, you know you are dealing with a reputable company. It even has its own Swiss banking license. Swissquote is also regulated by authorities in Dubai, Hong Kong and Singapore. For the Swiss entity, investor funds of up to CHF100,000 are protected. For the UK entity, investor protection is up to £85,000 per account.

Swissquote keeps the data and info of its clients very secure and client funds are kept segregated from the operational funds of the broker. You can enact extra security features on your accounts if you wish to do so. There is negative balance protection in place for CFD trading and forex spot trading from retail clients in the EU.

Suggested For You

Compare Swissquote

Find out how Swissquote stacks up against other brokers